//aberration策略================================================

//---------------------------------------------------------------------

Params

Numeric length (80);

Numeric lots (0);

Vars

Series<Numeric> avgout(0);

Series<Numeric> avgout2(0);

Series<Numeric> avgout3(0);

Series<Numeric> avgout4(0);

Series<Numeric> avgout5(0);

Series<Numeric> myvolav(0);

Series<Numeric> lps(0);

Series<Numeric> sps(0);

Series<Numeric> ps(0);

Series<Numeric> cnt(0);

Series<Numeric> lepnce(0);

Series<Numeric> sepnce(0);

Series<Numeric> sigma(0);

Events

OnBar(ArrayRef<Integer> indexs)

{

AvgOut =Average (close,length);

AvgOut2 =Average (close,length-intpart (length/8));

AvgOut3 =Average (close,length-intpart (length/8)*2);

AvgOut4 =Average (close,length-intpart (length/8)*3);

AvgOut5 =Average (close,length-intpart (length/8)*4);

sigma=(StandardDev(close,length)*2);

myvolav =(sigma+sigma[1] +sigma[2])/3;

lepnce=AvgOut+sigma;

sepnce=AvgOut-sigma;

//突破一倍标准差,进行建仓,限制条件中,有一条是必须跌回了最长期的均线后才能开仓,即是lps==0;

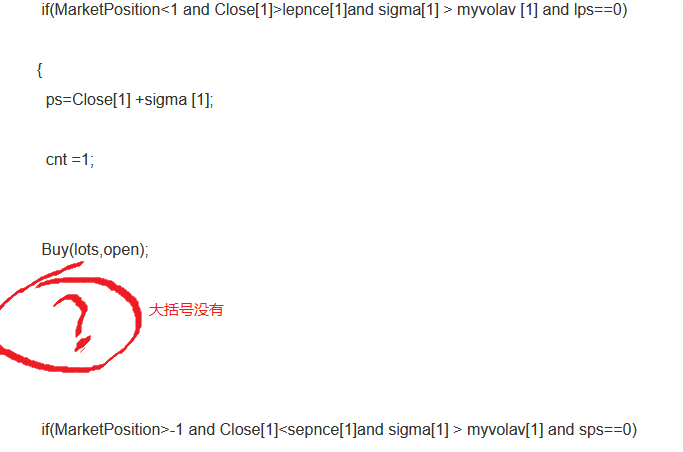

if(MarketPosition<1 and Close[1]>lepnce[1]and sigma[1] > myvolav [1] and lps==0)

{

ps=Close[1] +sigma [1];

cnt =1;

Buy(lots,open);

if(MarketPosition>-1 and Close[1]<sepnce[1]and sigma[1] > myvolav[1] and sps==0)

{

SellShort(lots,open);

ps=Close[1] -sigma [1];

cnt=1;

//跌破均线,进行平仓,盈利越多,跌破的均线周期越短

if(Marketposition==1 and close[1] < avgout [1] and cnt==1)

{

sell(0,open);

lps=0;

}

if(Marketposition==1 and close[1] < avgout2 [1] and cnt==2)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and close[1] < avgout3 [1] and cnt==3)

{

sell(0,open);

lps=1;

if(Marketposition==1 and close[1] < avgout4 [1] and cnt==4)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and close[1] < avgout5 [1] and cnt==5)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and cnt==6)

{

sell(0,open);

lps=1;

}

//开空

if(Marketposition==-1 and close[1] > avgout [1] and cnt==1)

{

BuyToCover(0,open);

SPS=0;

}

if(Marketposition==-1 and close[1] >avgout2 [1] and cnt==2)

{

BuyToCover(0,open);

SPS=1;

}

if(Marketposition==-1 and close[1] > avgout3 [1] and cnt==3)

{

BuyToCover (0,open);

SPS =1;

if(Marketposition==-1 and close[1] > avgout4 [1] and cnt==4)

{

BuyToCover(0,open);

SPS =1;

}

if(Marketposition==-1 and close[1] > avgout5 [1] and cnt==5)

{

BuyTocover(0,open);

SPS=1;

}

if(Marketposition==-1 and cnt==6)

{

BuyToCover(0,open);

SPS=1;

}

//更新盈利级别,按照sigma递增

if(MarketPosition==1 and close [1]>ps)

{

cnt=cnt+1;

ps=close[1]+sigma[1];

}

if(MarketPosition==-1 and close [1]<ps)

{

cnt=cnt+1;

ps=close[1]-sigma[1];

}

//只有当跌破最长期的均线后,才能准备下一次的开仓

if(sps ==1 and Close[1]>avgout[1])sps =0;

if(lps ==1 and Close[1]<avgout[1])lps =0;

}

}

}

我刚测试了这个策略,根本没法用啊

这不是已经是tbquant语法了吗

tbquant上,编译过不去,不知道为什么

编译不了,是因为代码内有多个大括号不对称,改下就好了。

//aberration策略================================================

//---------------------------------------------------------------------

Params

Numeric length (80);

Numeric lots (0);

Vars

Series<Numeric> avgout(0);

Series<Numeric> avgout2(0);

Series<Numeric> avgout3(0);

Series<Numeric> avgout4(0);

Series<Numeric> avgout5(0);

Series<Numeric> myvolav(0);

Series<Numeric> lps(0);

Series<Numeric> sps(0);

Series<Numeric> ps(0);

Series<Numeric> cnt(0);

Series<Numeric> lepnce(0);

Series<Numeric> sepnce(0);

Series<Numeric> sigma(0);

Events

OnBar(ArrayRef<Integer> indexs)

{

AvgOut =Average (close,length);

AvgOut2 =Average (close,length-intpart (length/8));

AvgOut3 =Average (close,length-intpart (length/8)*2);

AvgOut4 =Average (close,length-intpart (length/8)*3);

AvgOut5 =Average (close,length-intpart (length/8)*4);

sigma=(StandardDev(close,length)*2);

myvolav =(sigma+sigma[1] +sigma[2])/3;

lepnce=AvgOut+sigma;

sepnce=AvgOut-sigma;

//突破一倍标准差,进行建仓,限制条件中,有一条是必须跌回了最长期的均线后才能开仓,即是lps==0;

if(MarketPosition<1 and Close[1]>lepnce[1]and sigma[1] > myvolav [1] and lps==0)

{

ps=Close[1] +sigma [1];

cnt =1;

Buy(lots,open);

}

if(MarketPosition>-1 and Close[1]<sepnce[1]and sigma[1] > myvolav[1] and sps==0)

{

SellShort(lots,open);

ps=Close[1] -sigma [1];

cnt=1;

}

//跌破均线,进行平仓,盈利越多,跌破的均线周期越短

if(Marketposition==1 and close[1] < avgout [1] and cnt==1)

{

sell(0,open);

lps=0;

}

if(Marketposition==1 and close[1] < avgout2 [1] and cnt==2)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and close[1] < avgout3 [1] and cnt==3)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and close[1] < avgout4 [1] and cnt==4)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and close[1] < avgout5 [1] and cnt==5)

{

sell(0,open);

lps=1;

}

if(Marketposition==1 and cnt==6)

{

sell(0,open);

lps=1;

}

//开空

if(Marketposition==-1 and close[1] > avgout [1] and cnt==1)

{

BuyToCover(0,open);

SPS=0;

}

if(Marketposition==-1 and close[1] >avgout2 [1] and cnt==2)

{

BuyToCover(0,open);

SPS=1;

}

if(Marketposition==-1 and close[1] > avgout3 [1] and cnt==3)

{

BuyToCover (0,open);

SPS =1;

}

if(Marketposition==-1 and close[1] > avgout4 [1] and cnt==4)

{

BuyToCover(0,open);

SPS =1;

}

if(Marketposition==-1 and close[1] > avgout5 [1] and cnt==5)

{

BuyTocover(0,open);

SPS=1;

}

if(Marketposition==-1 and cnt==6)

{

BuyToCover(0,open);

SPS=1;

}

//更新盈利级别,按照sigma递增

if(MarketPosition==1 and close [1]>ps)

{

cnt=cnt+1;

ps=close[1]+sigma[1];

}

if(MarketPosition==-1 and close [1]<ps)

{

cnt=cnt+1;

ps=close[1]-sigma[1];

}

//只有当跌破最长期的均线后,才能准备下一次的开仓

if(sps ==1 and Close[1]>avgout[1])sps =0;

if(lps ==1 and Close[1]<avgout[1])lps =0;

}

谢谢