如何将tbquant上的策略转换成python代码

怎么把tbquant上的策略给转换成python代码啊?有大神能详细指点一下吗?生成出来的回测曲线一直跟软件上的完全不符,卡在这里好久了😭

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

class VolumeWeightedMomentumSys:

def __init__(self, data, mom_len=5, avg_len=20, atr_len=5, atr_pcnt=0.5, setup_len=5, fixed_size=1):

self.data = data

self.mom_len = mom_len

self.avg_len = avg_len

self.atr_len = atr_len

self.atr_pcnt = atr_pcnt

self.setup_len = setup_len

self.fixed_size = fixed_size

# Variables to track

self.vwm = None # 成交量加权动量

self.atr = None # ATR

self.se_price = 0 # 当前价格通道

self.ssetup = 0 # 条件计数器

self.intra_trade_high = 0

self.intra_trade_low = 0

self.position = 0 # 持仓:0为无仓,-1为空单

self.profits = [] # 用于存储交易盈亏

self.capital_curve = [] # 资金曲线

self.current_capital = 100000 # 初始资本

self.dates = [] # 保存完整的日期

self.init_indicators() # 初始化指标

def init_indicators(self):

"""初始化指标计算"""

# 计算动量

momentum = self.data['close'].diff(self.mom_len)

# 计算成交量加权动量 (VWM)

vol_momentum = self.data['vol'] * momentum

self.vwm = vol_momentum.rolling(window=self.avg_len).mean()

# 计算ATR

high_low = self.data['high'] - self.data['low']

high_close = (self.data['high'] - self.data['close'].shift()).abs()

low_close = (self.data['low'] - self.data['close'].shift()).abs()

true_range = pd.concat([high_low, high_close, low_close], axis=1).max(axis=1)

self.atr = true_range.rolling(window=self.atr_len).mean()

def on_bar(self, bar_index):

"""逐根K线回测逻辑"""

# 检查是否足够数据初始化

if bar_index < max(self.avg_len, self.atr_len):

# 保持资金和日期不变

self.capital_curve.append(self.current_capital)

self.dates.append(self.data.index[bar_index])

return

# 获取当前K线数据

bar = self.data.iloc[bar_index]

# 检查是否有持仓

if self.position == 0:

self.intra_trade_high = bar['high']

self.intra_trade_low = bar['low']

# 判断空头势

if self.vwm.iloc[bar_index] < 0:

self.ssetup = 0

self.se_price = bar['close']

else:

self.ssetup += 1

# 入场条件

if self.ssetup <= self.setup_len and self.ssetup >= 1:

entry_price = self.se_price - (self.atr.iloc[bar_index] * self.atr_pcnt)

if bar['low'] <= entry_price:

# 做空

self.position = -1

self.entry_price = entry_price

self.intra_trade_high = bar['high']

print(f"Sell short at {entry_price} on {bar.name}")

elif self.position == -1:

# 更新最高价格

self.intra_trade_high = max(self.intra_trade_high, bar['high'])

# 出场条件

if self.vwm.iloc[bar_index] > 0:

exit_price = bar['open'] # 平仓价为开盘价

profit = (self.entry_price - exit_price) * self.fixed_size

self.current_capital += profit # 更新资金

self.profits.append(profit)

self.position = 0

print(f"Buy to cover at {exit_price} on {bar.name}. Profit: {profit}")

# 记录资金曲线和日期

self.capital_curve.append(self.current_capital)

self.dates.append(bar.name)

def backtest(self):

"""运行回测"""

for i in range(len(self.data)):

self.on_bar(i)

# 打印总盈亏

total_profit = sum(self.profits)

print(f"Total profit: {total_profit}")

return self.capital_curve, self.dates

# 加载数据

open_data = pd.read_csv(r'C:\Users\User\Desktop\data(min5)\open.csv', index_col=0, parse_dates=True)

close_data = pd.read_csv(r'C:\Users\User\Desktop\data(min5)\close.csv', index_col=0, parse_dates=True)

high_data = pd.read_csv(r'C:\Users\User\Desktop\data(min5)\high.csv', index_col=0, parse_dates=True)

low_data = pd.read_csv(r'C:\Users\User\Desktop\data(min5)\low.csv', index_col=0, parse_dates=True)

vol_data = pd.read_csv(r'C:\Users\User\Desktop\data(min5)\vol.csv', index_col=0, parse_dates=True)

# 将数据合并成一个DataFrame

data = pd.DataFrame({

'open': open_data['ag'],

'close': close_data['ag'],

'high': high_data['ag'],

'low': low_data['ag'],

'vol': vol_data['ag'],

}, index=open_data.index)

# 初始化策略

strategy = VolumeWeightedMomentumSys(data)

# 回测

profits, dates = strategy.backtest()

# 绘制资金曲线

plt.figure(figsize=(12, 6))

plt.plot(dates, np.cumsum(profits), label='Cumulative Profit') # 累积盈亏

plt.xlabel('Date')

plt.ylabel('Profit')

plt.title('Capital Curve Over Time')

plt.legend()

plt.grid()

plt.show()

//------------------------------------------------------------------------

// 简称: VolumeWeightedMomentumSys_S

// 名称: 成交量加权动量交易系统 空

// 类别: 策略应用

// 类型: 内建应用

// 输出:

// 策略说明:

// 基于动量系统, 通过交易量加权进行判断

//

// 系统要素:

// 1. 用UWM下穿零轴判断空头趋势

// 入场条件:

// 1. 价格低于UWM下穿零轴时价格通道,在SetupLen的BAR数目内,做空

//

// 出场条件:

// 1. 多头势空单出场

// 注:

//----------------------------------------------------------------------//

Params

Numeric MomLen(5); //UWM参数

Numeric AvgLen(20); //UWM参数

Numeric ATRLen(5); //ATR参数

Numeric ATRPcnt(0.5); //入场价格波动率参数

Numeric SetupLen(5); //条件持续有效K线数

Vars

Series<Numeric> VWM(0);

Series<Numeric> AATR(0);

Series<Numeric> SEPrice(0);

Series<Bool> BullSetup(False);

Series<Bool> BearSetup(False);

Series<Numeric> SSetup(0);

Events

OnBar(ArrayRef<Integer> indexs)

{

VWM = XAverage(Vol * Momentum(Close, MomLen), AvgLen); //定义UWM

AATR = AvgTrueRange(ATRLen); //ATR

BullSetup = CrossOver(VWM,0); //UWM上穿零轴定义多头势

BearSetup = CrossUnder(VWM,0); //UWM下穿零轴定义空头势

If (BearSetup ) //空头势开始计数并记录当前价格

{

SSetup = 0;

SEPrice = Close;

}

Else SSetup = SSetup[1] + 1; //每过一根BAR计数

//系统入场

If (CurrentBar > AvgLen And MarketPosition == 0 ) //当空头势满足并且在SetupLen的BAR数目内,当价格达到入场价格后,做空

{

If( Low <=SEPrice[1] - (ATRPcnt * AATR[1]) And SSetup[1] <= SetupLen And SSetup >= 1 And Vol > 0)

{

SellShort(0, Min(Open,SEPrice[1] - (ATRPcnt * AATR[1]))) ;

}

}

//系统出场

If (MarketPosition == -1 And BarsSinceEntry > 0 And Vol > 0) //多头势平掉空单

{

If( BullSetup[1] == True )

{

Buytocover(0,Open);

}

}

}

//------------------------------------------------------------------------

// 编译版本 GS2014.10.25

// 版权所有 TradeBlazer Software 2003-2025

// 更改声明 TradeBlazer Software保留对TradeBlazer平

// 台每一版本的TradeBlazer公式修改和重写的权利

//------------------------------------------------------------------------

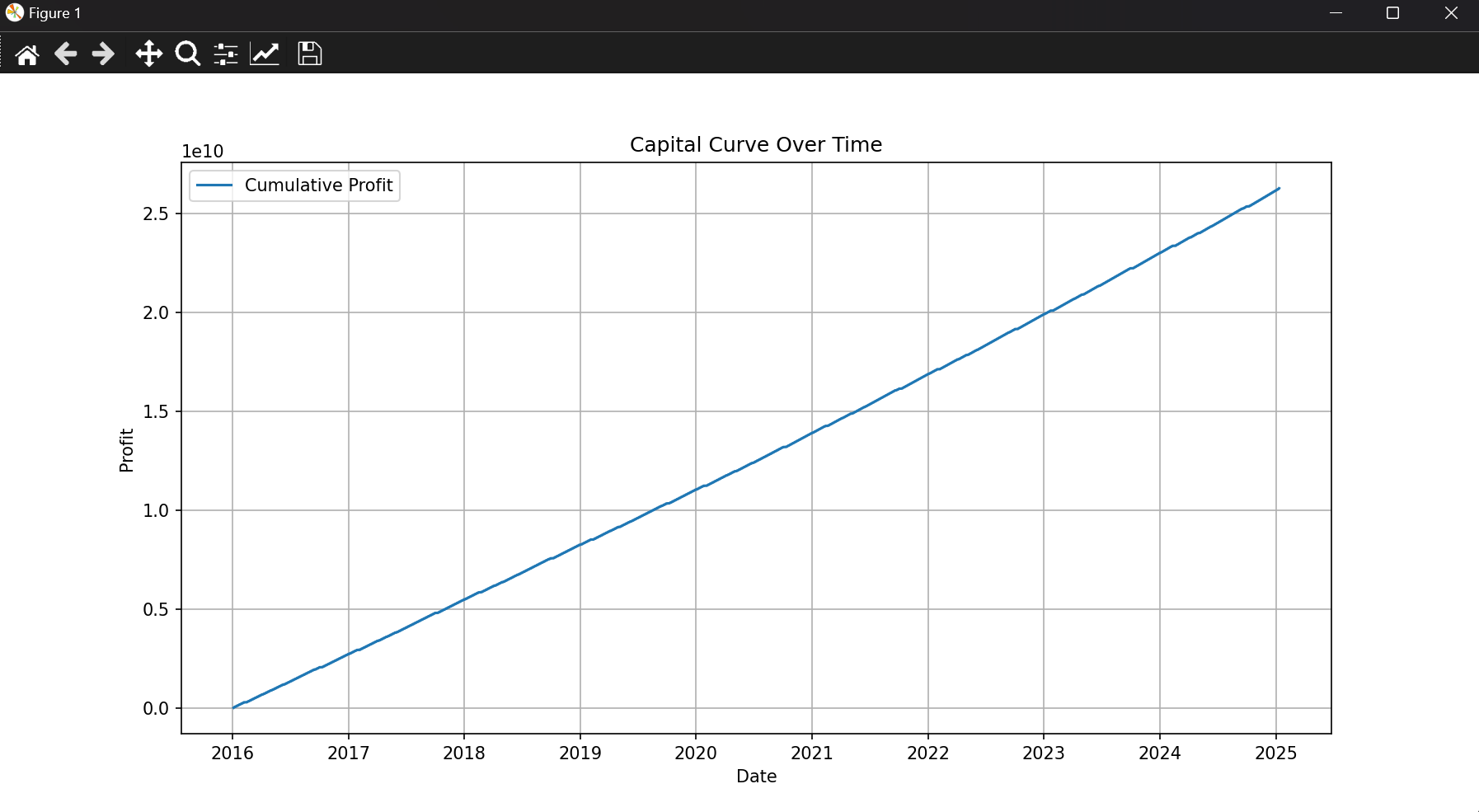

python每次跑出来的曲线都差不多长这样的,跟tb上完全不一样😭