调用

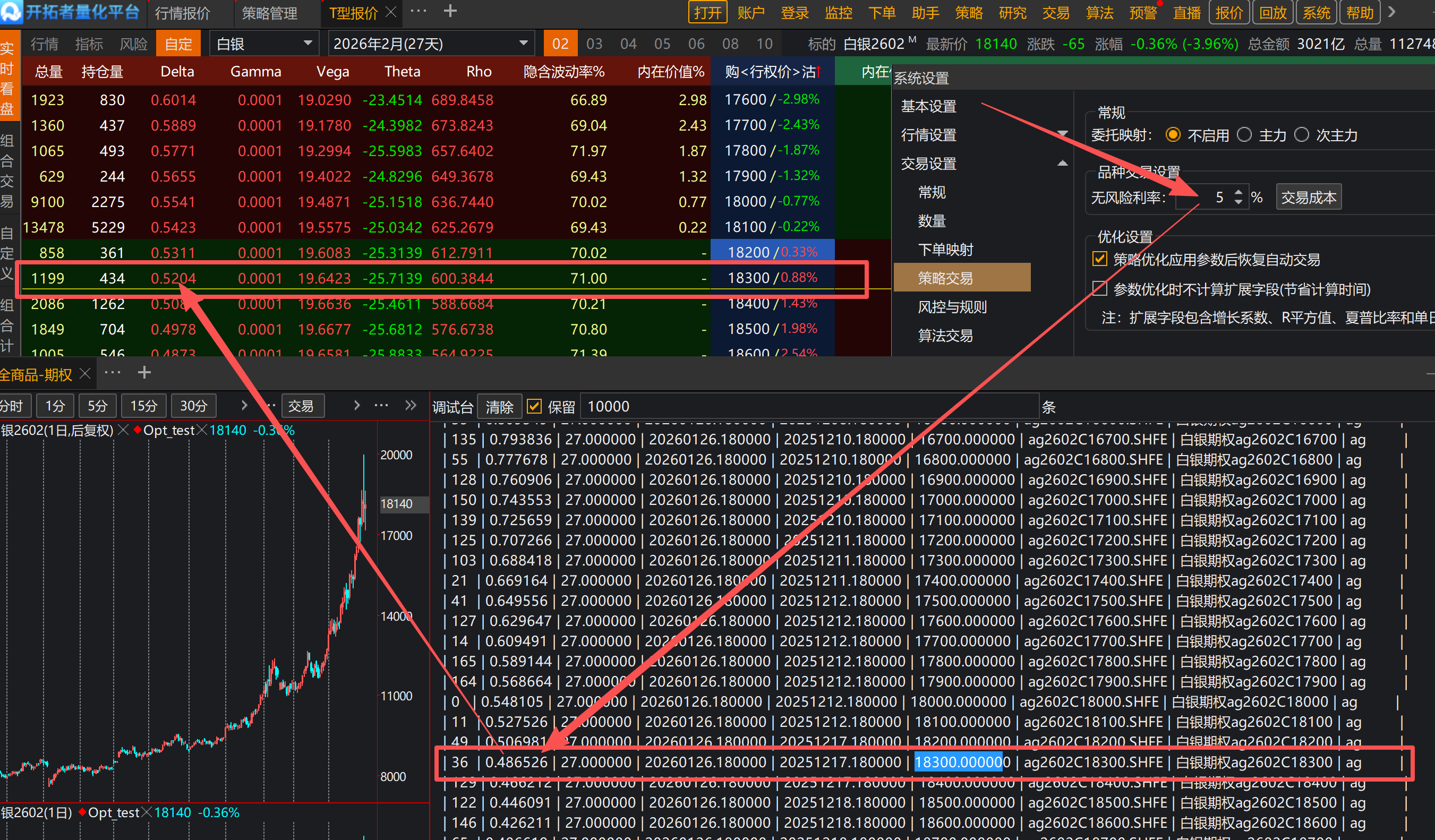

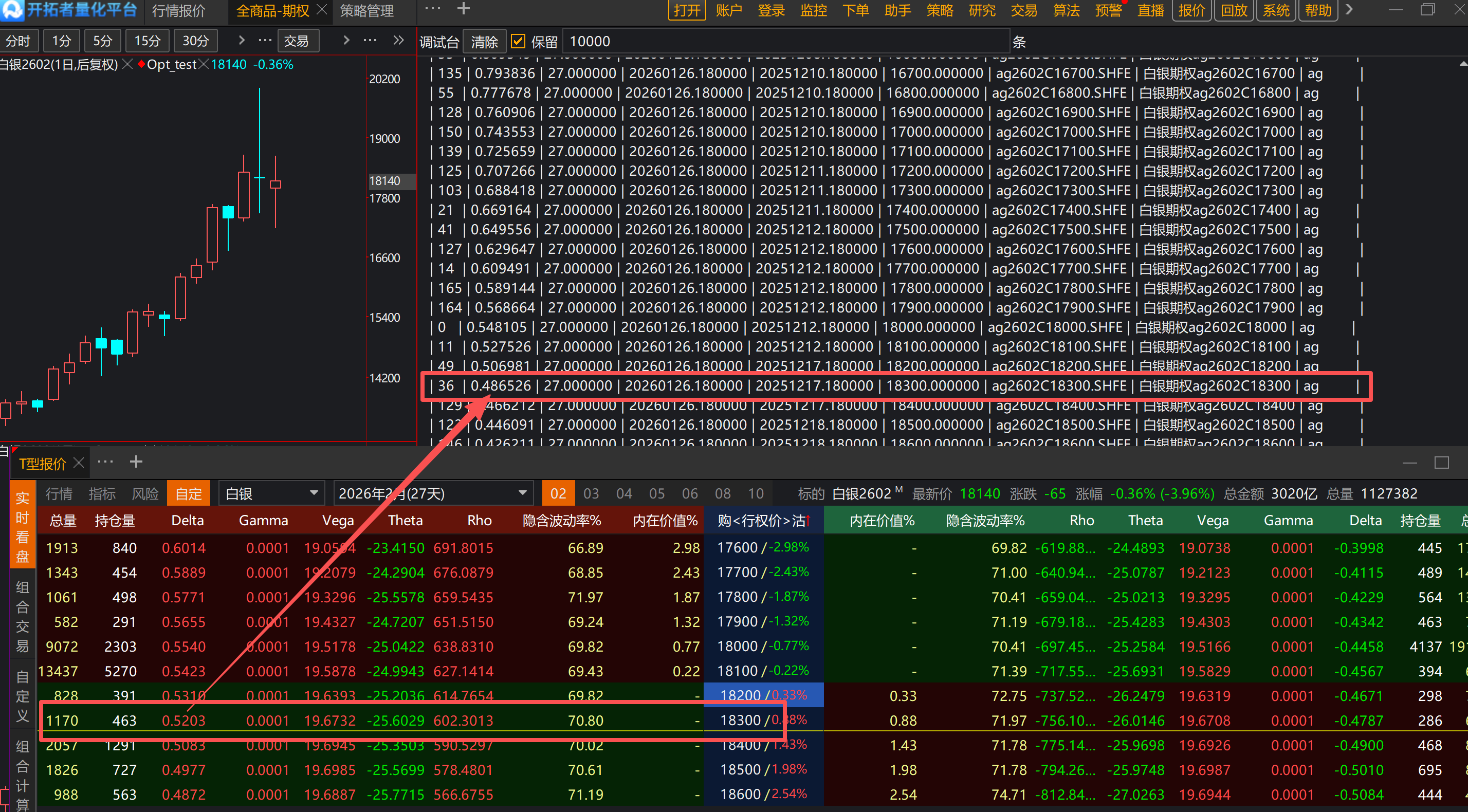

OptionsComplex(3, DateDiff(SystemDateTime, props.ExpiredDateTime), props.strikePrice, data[id].Close, 5, 0, 0, volty, Enum_CallOption, Enum_EuropeanOption, oOptPrice, oDelta, oGamma, oVega, oTheta, oRho)计算出来的希腊值和行情界面显示的希腊值有很大的差异,这个原因是什么?可以复测的代码逻辑如下,麻烦老师给把把脉:

//------------------------------------------------------------------------

// 简称: opt_test

// 名称:

// 类别: 策略应用

// 类型: 用户应用

// 输出: Void

//------------------------------------------------------------------------

Params

Vars

//此处添加变量

Numeric i;

Global Array<string> Callcontracts;

CodeProperty props;

Map<String, Array<Numeric>> map_call; // 定义看涨(Call)和看跌(Put)的数据容器

Map<String, Array<Numeric>> map_put;

DataFrame df1;

DataFrame df2;

Events

//此处实现事件函数

//初始化事件函数,策略运行期间,首先运行且只有一次,应用在订阅数据等操作

OnInit()

{

GetOptSymbolsByCode(symbol, Callcontracts);

}

OnBar(ArrayRef<Integer> indexs)

{

// 字符串列数组

Array<String> symbol_call;

Array<String> symbolName_call;

Array<String> symbolType_call;

Array<String> symbol_put;

Array<String> symbolName_put;

Array<String> symbolType_put;

// 索引计数器

Numeric idx_call = 0;

Numeric idx_put = 0;

Numeric oOptPrice(0);

Numeric oDelta(0);

Numeric oGamma(0);

Numeric oVega(0);

Numeric oTheta(0);

Numeric oRho(0);

Numeric volty = Volatility(data[id].Close);

for i = 0 to GetArraySize(Callcontracts) - 1

{

GetProperty(Callcontracts[i], props);

String sym = props.Symbol; // 如 "ag2602C23100.SHFE"

// 检查是否包含 'C'(看涨)

if (FindFirstOf(sym, "C") != InvalidInteger)

{

OptionsComplex(3, DateDiff(SystemDateTime, props.ExpiredDateTime), props.strikePrice, data[id].Close, 5, 0, 0, volty, Enum_CallOption, Enum_EuropeanOption, oOptPrice, oDelta, oGamma, oVega, oTheta, oRho);

map_call["ExpiredDateTime"][idx_call] = props.ExpiredDateTime;

map_call["OpenDateTime"][idx_call] = props.OpenDateTime;

map_call["DueDays"][idx_call] = DateDiff(SystemDateTime, props.ExpiredDateTime);

map_call["strikePrice"][idx_call] = props.strikePrice;

map_call["Delta"][idx_call] = oDelta;

symbol_call[idx_call] = sym;

symbolName_call[idx_call] = props.SymbolName;

symbolType_call[idx_call] = props.symbolType;

idx_call = idx_call + 1;

}

// 检查是否包含 'P'(看跌)

else if (FindFirstOf(sym, "P") != InvalidInteger)

{

OptionsComplex(3, DateDiff(SystemDateTime, props.ExpiredDateTime), props.strikePrice, data[id].Close, 5, 0, 0, volty, Enum_PutOption, Enum_EuropeanOption, oOptPrice, oDelta, oGamma, oVega, oTheta, oRho);

map_put["ExpiredDateTime"][idx_put] = props.ExpiredDateTime;

map_put["OpenDateTime"][idx_put] = props.OpenDateTime;

map_put["DueDays"][idx_put] = DateDiff(SystemDateTime, props.ExpiredDateTime);

map_put["strikePrice"][idx_put] = props.strikePrice;

map_put["Delta"][idx_put] = oDelta;

symbol_put[idx_put] = sym;

symbolName_put[idx_put] = props.SymbolName;

symbolType_put[idx_put] = props.symbolType;

idx_put = idx_put + 1;

}

// 可选:else 忽略不合规合约(如无 C/P 的异常数据)

}

// ========== 构建 df1(Call)==========

df1.init(map_call);

df1.setPos("Symbol", [:], symbol_call);

df1.setPos("SymbolName", [:], symbolName_call);

df1.setPos("symbolType", [:], symbolType_call);

// ========== 构建 df2(Put)==========

df2.init(map_put);

df2.setPos("Symbol", [:], symbol_put);

df2.setPos("SymbolName", [:], symbolName_put);

df2.setPos("symbolType", [:], symbolType_put);

// ========== 按 strikePrice 升序排序 ==========

df1.sort_values("strikePrice", true); // true = 升序

df2.sort_values("strikePrice", true);

// 输出

print("=== Call Options (df1) ===");

print(df1.toString());

print("=== Put Options (df2) ===");

print(df2.toString());

}

利率填的多少

5,参照了示例的数值

类型为期货(MyAssetType = 3),分红收率、外币无风险利率都填的0

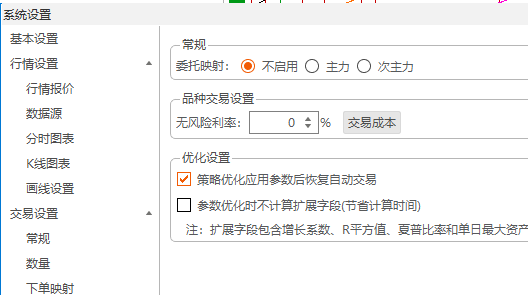

系统设置可以看下是不是一样,

将无风险利率设置为与OptionsComplex函数一致,刷新出来的数据差异没有改善。