// 通用5分钟MA5-MA200交叉策略(含回本保护+反手)

Params

Numeric MA5_Period(5);

Numeric MA200_Period(200);

Numeric MinMove(2);

Numeric StopProfit_Pts(100);

Numeric Slippage_Pts(1);

Numeric Commission_Rate(0.00015);

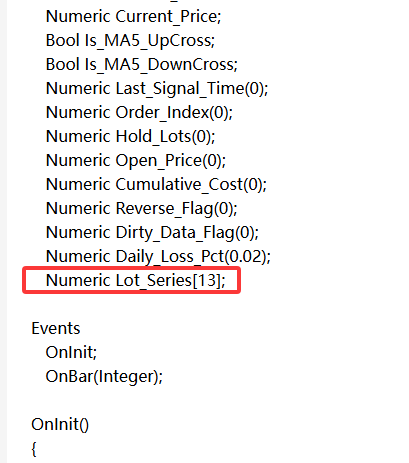

Vars

Numeric MA5;

Numeric MA200;

Numeric MA5_Prev;

Numeric MA200_Prev;

Numeric Current_Price;

Bool Is_MA5_UpCross;

Bool Is_MA5_DownCross;

Numeric Last_Signal_Time(0);

Numeric Order_Index(0);

Numeric Hold_Lots(0);

Numeric Open_Price(0);

Numeric Cumulative_Cost(0);

Numeric Reverse_Flag(0);

Numeric Dirty_Data_Flag(0);

Numeric Daily_Loss_Pct(0.02);

Numeric Lot_Series[13];

Events

OnInit;

OnBar(Integer);

OnInit()

{

Lot_Series[0] = 1;

Lot_Series[1] = 2;

Lot_Series[2] = 2;

Lot_Series[3] = 3;

Lot_Series[4] = 3;

Lot_Series[5] = 4;

Lot_Series[6] = 4;

Lot_Series[7] = 5;

Lot_Series[8] = 5;

Lot_Series[9] = 6;

Lot_Series[10] = 6;

Lot_Series[11] = 7;

Lot_Series[12] = 7;

SetCommissionRate(Commission_Rate);

SetSlippage(Slippage_Pts * MinMove);

Print("【MA5_200_Universal】Initialized.");

}

OnBar(Integer index)

{

DateTime t = CurrentTime();

Numeric hour = GetHour(t);

Numeric minute = GetMinute(t);

Numeric second = GetSecond(t);

Numeric now_ms = second * 1000 + minute * 60000 + hour * 3600000;

if ((hour == 10 && minute >= 15 && minute < 30) ||

(hour >= 11 && hour < 13) ||

(hour == 14 && minute >= 55))

{

return;

}

Current_Price = Close;

if (Current_Price <= 0 || High <= Low || Volume <= 0 || IsNaN(Current_Price))

{

return;

}

MA5 = MA(Close, MA5_Period);

MA200 = MA(Close, MA200_Period);

MA5_Prev = Ref(MA5, 1);

MA200_Prev = Ref(MA200, 1);

if (MA5 <= 0 || MA200 <= 0 || MA5_Prev <= 0 || MA200_Prev <= 0)

{

return;

}

Is_MA5_UpCross = (MA5 > MA200) && (MA5_Prev <= MA200_Prev) && (MA5 - MA200 >= MinMove);

Is_MA5_DownCross = (MA5 < MA200) && (MA5_Prev >= MA200_Prev) && (MA200 - MA5 >= MinMove);

if ((Is_MA5_UpCross || Is_MA5_DownCross) && (now_ms - Last_Signal_Time < 5 * 60 * 1000))

{

Is_MA5_UpCross = False;

Is_MA5_DownCross = False;

return;

}

Numeric long_lots = CurrentContracts(Enum_Position_Long);

Numeric short_lots = CurrentContracts(Enum_Position_Short);

Numeric total_hold = long_lots + short_lots;

if (total_hold == 0 && Order_Index == 0)

{

if (Is_MA5_UpCross)

{

Numeric lot = Lot_Series[0];

Buy(lot, Open + Slippage_Pts * MinMove);

Open_Price = Open + Slippage_Pts * MinMove;

Hold_Lots = lot;

Order_Index = 1;

Last_Signal_Time = now_ms;

Print("[First Long]", lot, "@", NumToStr(Open_Price, 2));

}

else if (Is_MA5_DownCross)

{

Numeric lot = Lot_Series[0];

SellShort(lot, Open - Slippage_Pts * MinMove);

Open_Price = Open - Slippage_Pts * MinMove;

Hold_Lots = lot;

Order_Index = 1;

Last_Signal_Time = now_ms;

Print("[First Short]", lot, "@", NumToStr(Open_Price, 2));

}

}

if (long_lots > 0 && Is_MA5_DownCross && Reverse_Flag == 0)

{

Sell(long_lots, Open - Slippage_Pts * MinMove);

Numeric close_px = Open - Slippage_Pts * MinMove;

Cumulative_Cost += (Open_Price - close_px);

Numeric idx = Min(Order_Index, 12);

Numeric new_lot = Lot_Series[idx];

SellShort(new_lot, close_px);

Open_Price = close_px;

Hold_Lots = new_lot;

Order_Index = idx + 1;

Reverse_Flag = 1;

Last_Signal_Time = now_ms;

Print("[Reverse L->S]", long_lots, "->", new_lot, "Cost:", NumToStr(Cumulative_Cost, 1));

}

if (short_lots > 0 && Is_MA5_UpCross && Reverse_Flag == 0)

{

BuyToCover(short_lots, Open + Slippage_Pts * MinMove);

Numeric close_px = Open + Slippage_Pts * MinMove;

Cumulative_Cost += (close_px - Open_Price);

Numeric idx = Min(Order_Index, 12);

Numeric new_lot = Lot_Series[idx];

Buy(new_lot, close_px);

Open_Price = close_px;

Hold_Lots = new_lot;

Order_Index = idx + 1;

Reverse_Flag = 1;

Last_Signal_Time = now_ms;

Print("[Reverse S->L]", short_lots, "->", new_lot, "Cost:", NumToStr(Cumulative_Cost, 1));

}

if (Hold_Lots >= 2 && Cumulative_Cost > 0)

{

if (long_lots > 0)

{

Numeric profit_per = Current_Price - Open_Price;

Numeric remain = Hold_Lots - 1;

if (remain * profit_per >= Cumulative_Cost)

{

Sell(remain, Open - Slippage_Pts * MinMove);

Hold_Lots = 1;

Cumulative_Cost = 0;

Print("[BE Long] Close", remain);

}

}

if (short_lots > 0)

{

Numeric profit_per = Open_Price - Current_Price;

Numeric remain = Hold_Lots - 1;

if (remain * profit_per >= Cumulative_Cost)

{

BuyToCover(remain, Open + Slippage_Pts * MinMove);

Hold_Lots = 1;

Cumulative_Cost = 0;

Print("[BE Short] Close", remain);

}

}

}

if (Hold_Lots == 1 && Cumulative_Cost == 0)

{

if (long_lots == 1 && (Current_Price - Open_Price) >= StopProfit_Pts)

{

Sell(1, Open - Slippage_Pts * MinMove);

Print("[TP Long]", NumToStr(Current_Price - Open_Price, 1), "pts");

Reset_State();

}

if (short_lots == 1 && (Open_Price - Current_Price) >= StopProfit_Pts)

{

BuyToCover(1, Open + Slippage_Pts * MinMove);

Print("[TP Short]", NumToStr(Open_Price - Current_Price, 1), "pts");

Reset_State();

}

}

Numeric equity = PortfolioTotalValue();

Numeric init_eq = PortfolioInitialValue();

if (init_eq > 0)

{

Numeric loss_pct = (init_eq - equity) / init_eq;

if (loss_pct >= Daily_Loss_Pct)

{

if (long_lots > 0) Sell(long_lots, Open - Slippage_Pts * MinMove);

if (short_lots > 0) BuyToCover(short_lots, Open + Slippage_Pts * MinMove);

Print("[CIRCUIT BREAKER]", NumToStr(loss_pct * 100, 2), "%");

Reset_State();

}

}

}

Void Reset_State()

{

Order_Index = 0;

Hold_Lots = 0;

Open_Price = 0;

Cumulative_Cost = 0;

Reverse_Flag = 0;

Last_Signal_Time = 0;

}

没有这种用法