程序理念:1、使用5、10周期均线,金叉开多单,死叉平仓。止损设置为开仓当根K线的前5根k线的最低点;2、出现盘中金叉,收盘未金叉的情况,次根k线平仓;出现盘中死叉、收盘未死叉的情况,次根K线开仓;3、突破近5根k线的最高点且无持仓时,买入开仓;4、自开仓以来存在大于开仓当根K线最高点的价位,且出现死叉时,平仓。

使用时,出现一下情况,1、设置的止损未起作用,仍然出现横盘阶段反复开平、磨损的情况;2、添加上述第4条那个条件后,复盘时,K线不再显示买入、卖出的箭头以及表示盈亏的虚线,是否不起作用了。

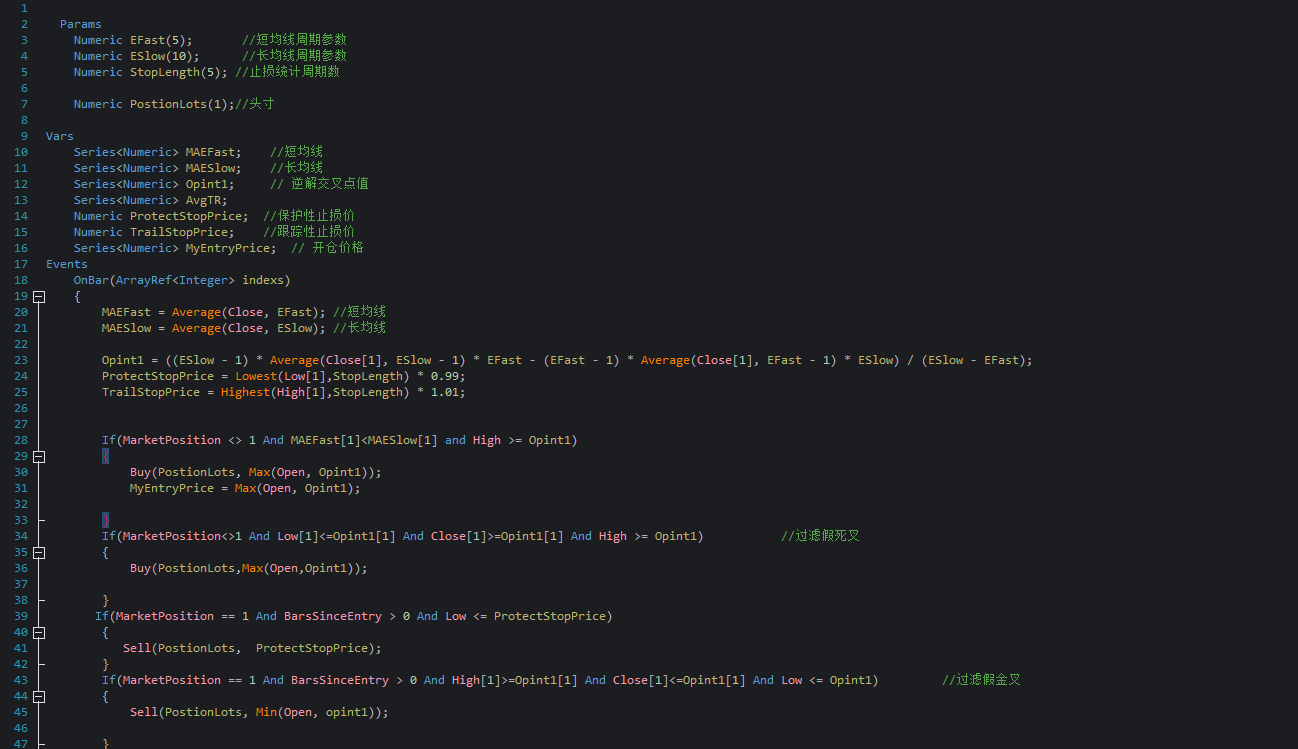

源代码如下(程序理念那个第4条暂未添加):

请问该如何优化?谢谢!

请问该如何优化?谢谢!

略微增加调试代码

不是可以止损的吗

PlotNumeric("ProtectStopPrice", ProtectStopPrice);

If(MarketPosition == 1 And BarsSinceEntry > 0 And Low <= ProtectStopPrice)

{

Sell(PostionLots, ProtectStopPrice);

PlotAuto("zhi", "止损",close);

}然后请针对你描述的所有问题,举例

比如你认为 “设置的止损未起作用”

请给出什么品种,几分几秒,图上哪里没止损

1、止损设置为开仓当根K线的前5根k线的最低点;

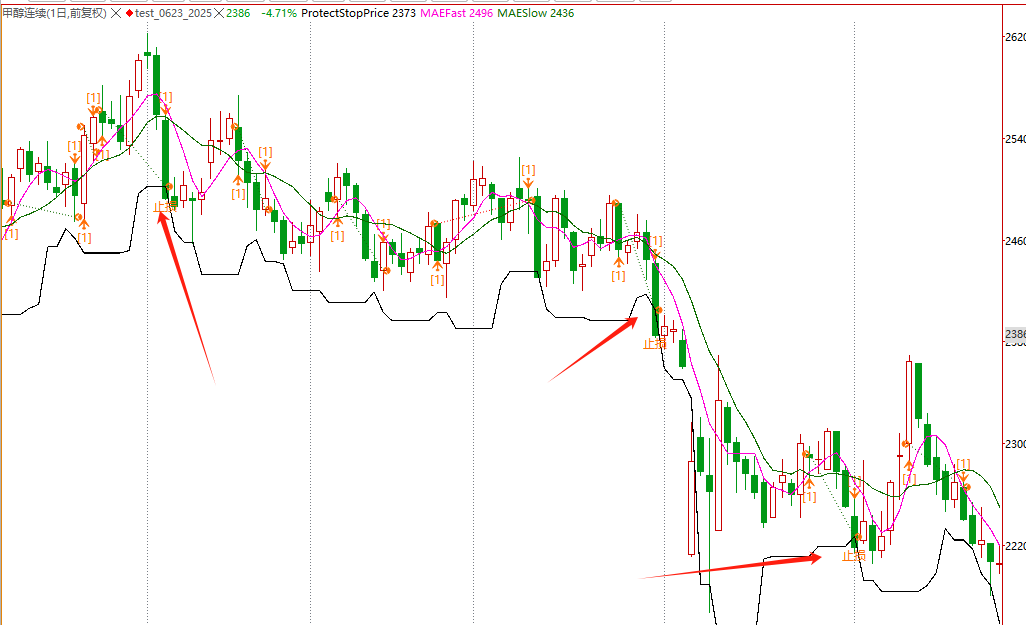

代码里体现不出来你固定了止损位开仓当根,只能看出来你随时在更新为前五根低点的0.99

如果你要固定,要写在开仓代码下面

2、你用Opint1变量来过滤假金叉死叉,这个变量的数据你确定是这么算的吗?画出来是这样

玫粉色这根

谢谢,请问如果要设置开仓价位当根K线,前5根K线最低点下2个基点,该怎么设置?

Params

Numeric EFast(5); //短均线周期参数

Numeric ESlow(10); //长均线周期参数

Numeric StopLength(5); //止损统计周期数

Numeric PostionLots(1);//头寸

Vars

Series<Numeric> MAEFast; //短均线

Series<Numeric> MAESlow; //长均线

Series<Numeric> Opint1; // 逆解交叉点值

Series<Numeric> AvgTR;

Numeric ProtectStopPrice; //保护性止损价

Numeric TrailStopPrice; //跟踪性止损价

Series<Numeric> MyEntryPrice; // 开仓价格

Events

OnBar(ArrayRef<Integer> indexs)

{

MAEFast = Average(Close, EFast); //短均线

MAESlow = Average(Close, ESlow); //长均线

Opint1 = ((ESlow - 1) * Average(Close[1], ESlow - 1) * EFast - (EFast - 1) * Average(Close[1], EFast - 1) * ESlow) / (ESlow - EFast);

ProtectStopPrice = Lowest(Low[1],StopLength) * 0.99;

TrailStopPrice = Highest(High[1],StopLength) * 1.01;

If(MarketPosition <> 1 And MAEFast[1]<MAESlow[1] and High >= Opint1)

{

Buy(PostionLots, Max(Open, Opint1));

MyEntryPrice = Max(Open, Opint1);

}

If(MarketPosition<>1 And Low[1]<=Opint1[1] And Close[1]>=Opint1[1] And High >= Opint1) //过滤假死叉

{

Buy(PostionLots,Max(Open,Opint1));

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And Low <= ProtectStopPrice)

{

Sell(PostionLots, ProtectStopPrice);

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And High[1]>=Opint1[1] And Close[1]<=Opint1[1] And Low <= Opint1) //过滤假金叉

{

Sell(PostionLots, Min(Open, opint1));

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And MAEFast[1]> MAESlow[1] And Low<Opint1)

{

Sell(PostionLots,Min(Open,Opint1));

}

Range[0:DataSourceSize() - 1]

{

PlotNumeric("MAEFast", MAEFast);

PlotNumeric("MAESlow", MAESlow);

}

你贴的3个代码都没有贴全 ,无法运行

是全的啊

1.贴代码用代码模式

2.止损未起作用 ,是怎么个不起作用

3.优化一般指优化参数,不要和改错 改bug混淆

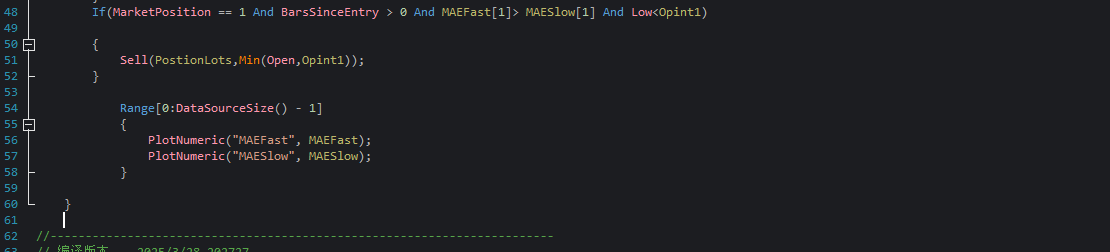

Params

Numeric EFast(5); //短均线周期参数

Numeric ESlow(10); //长均线周期参数

Numeric StopLength(5); //止损统计周期数

Numeric PostionLots(1);//头寸

Vars

Series<Numeric> MAEFast; //短均线

Series<Numeric> MAESlow; //长均线

Series<Numeric> Opint1; // 逆解交叉点值

Series<Numeric> AvgTR;

Numeric ProtectStopPrice; //保护性止损价

Numeric TrailStopPrice; //跟踪性止损价

Series<Numeric> MyEntryPrice; // 开仓价格

Events

OnBar(ArrayRef<Integer> indexs)

{

MAEFast = Average(Close, EFast); //短均线

MAESlow = Average(Close, ESlow); //长均线

Opint1 = ((ESlow - 1) * Average(Close[1], ESlow - 1) * EFast - (EFast - 1) * Average(Close[1], EFast - 1) * ESlow) / (ESlow - EFast);

ProtectStopPrice = Lowest(Low[1],StopLength) * 0.99;

TrailStopPrice = Highest(High[1],StopLength) * 1.01;

If(MarketPosition <> 1 And MAEFast[1]<MAESlow[1] and High >= Opint1)

{

Buy(PostionLots, Max(Open, Opint1));

MyEntryPrice = Max(Open, Opint1);

}

If(MarketPosition<>1 And Low[1]<=Opint1[1] And Close[1]>=Opint1[1] And High >= Opint1) //过滤假死叉

{

Buy(PostionLots,Max(Open,Opint1));

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And Low <= ProtectStopPrice)

{

Sell(PostionLots, ProtectStopPrice);

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And High[1]>=Opint1[1] And Close[1]<=Opint1[1] And Low <= Opint1) //过滤假金叉

{

Sell(PostionLots, Min(Open, opint1));

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And MAEFast[1]> MAESlow[1] And Low<Opint1)

{

Sell(PostionLots,Min(Open,Opint1));

}

Range[0:DataSourceSize() - 1]

{

PlotNumeric("MAEFast", MAEFast);

PlotNumeric("MAESlow", MAESlow);

}

Params

Numeric EFast(5); //短均线周期参数

Numeric ESlow(10); //长均线周期参数

Numeric StopLength(5); //止损统计周期数

Numeric PostionLots(1);//头寸

Vars

Series<Numeric> MAEFast; //短均线

Series<Numeric> MAESlow; //长均线

Series<Numeric> Opint1; // 逆解交叉点值

Series<Numeric> AvgTR;

Numeric ProtectStopPrice; //保护性止损价

Numeric TrailStopPrice; //跟踪性止损价

Series<Numeric> MyEntryPrice; // 开仓价格

Events

OnBar(ArrayRef<Integer> indexs)

{

MAEFast = Average(Close, EFast); //短均线

MAESlow = Average(Close, ESlow); //长均线

Opint1 = ((ESlow - 1) * Average(Close[1], ESlow - 1) * EFast - (EFast - 1) * Average(Close[1], EFast - 1) * ESlow) / (ESlow - EFast);

ProtectStopPrice = Lowest(Low[1],StopLength) * 0.99;

TrailStopPrice = Highest(High[1],StopLength) * 1.01;

If(MarketPosition <> 1 And MAEFast[1]<MAESlow[1] and High >= Opint1)

{

Buy(PostionLots, Max(Open, Opint1));

MyEntryPrice = Max(Open, Opint1);

}

If(MarketPosition<>1 And Low[1]<=Opint1[1] And Close[1]>=Opint1[1] And High >= Opint1) //过滤假死叉

{

Buy(PostionLots,Max(Open,Opint1));

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And Low <= ProtectStopPrice)

{

Sell(PostionLots, ProtectStopPrice);

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And High[1]>=Opint1[1] And Close[1]<=Opint1[1] And Low <= Opint1) //过滤假金叉

{

Sell(PostionLots, Min(Open, opint1));

}

If(MarketPosition == 1 And BarsSinceEntry > 0 And MAEFast[1]> MAESlow[1] And Low<Opint1)

{

Sell(PostionLots,Min(Open,Opint1));

}

Range[0:DataSourceSize() - 1]

{

PlotNumeric("MAEFast", MAEFast);

PlotNumeric("MAESlow", MAESlow);

}

设置了sell前5周期最低点,但是体现在k线上,没有平掉

设置了sell前5周期最低点,但是体现在k线上,没有平掉